Loan Origination System

Automates the Loan origination process for efficiency, transparency, and insights.

software

What is the Loan Origination System?

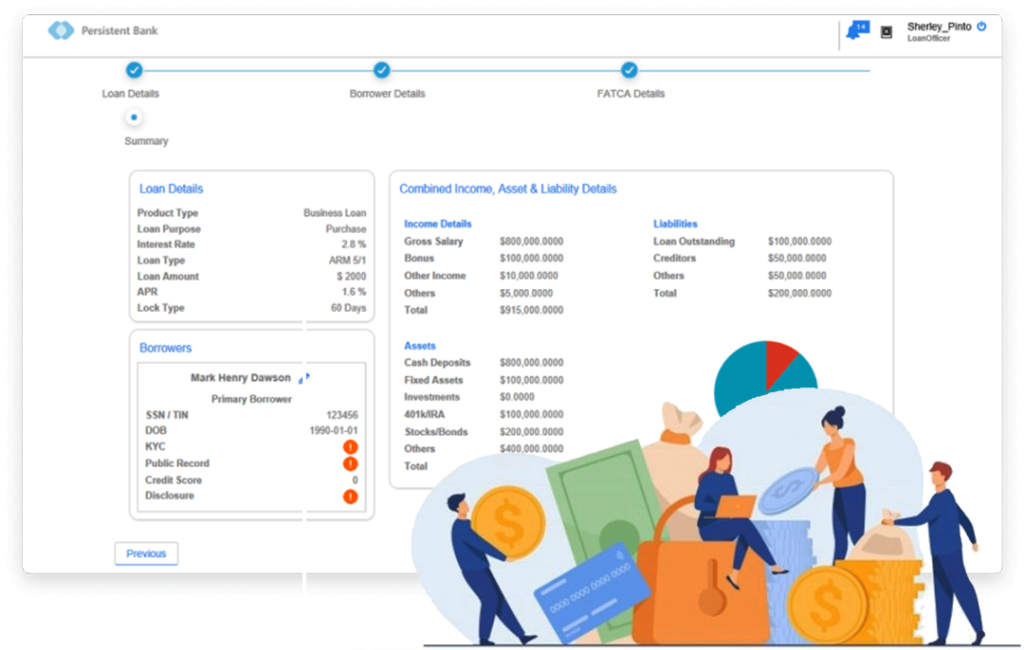

The Loan Origination System (LOS) digitizes the manual loan requisition and approval process within financial institutions. LOS enables relationship managers to easily create a loan request based on customer details provided and upload the necessary supporting documents for approval. Based on predefined routing rules, the request is automatically sent to the respective approvers. Following final authorization, the system automatically generates the offer letter and keeps record of the correspondence.

Enhanced loan visibility

360-degree view of loan process for timely feedback and oversight

Integration with core banking app

The system can be integrated with the institution’s core banking app to allow for pre-population of relevant customer details

Credit review and credit scoring

Automatic credit review and credit scoring on the lending policy integrated to ease and fast-track the loan process

Rich data repository

Because all records are kept and well-analyzed, it serves as a rich repository for potentials borrowers.

Analytics

Rich visuals embedded to drive business decisions based on data collected